Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Filling the Gap: A Comprehensive Guide to Gap Insurance. Let's weave interesting information and offer fresh perspectives to the readers.

Table of Content

Filling the Gap: A Comprehensive Guide to Gap Insurance

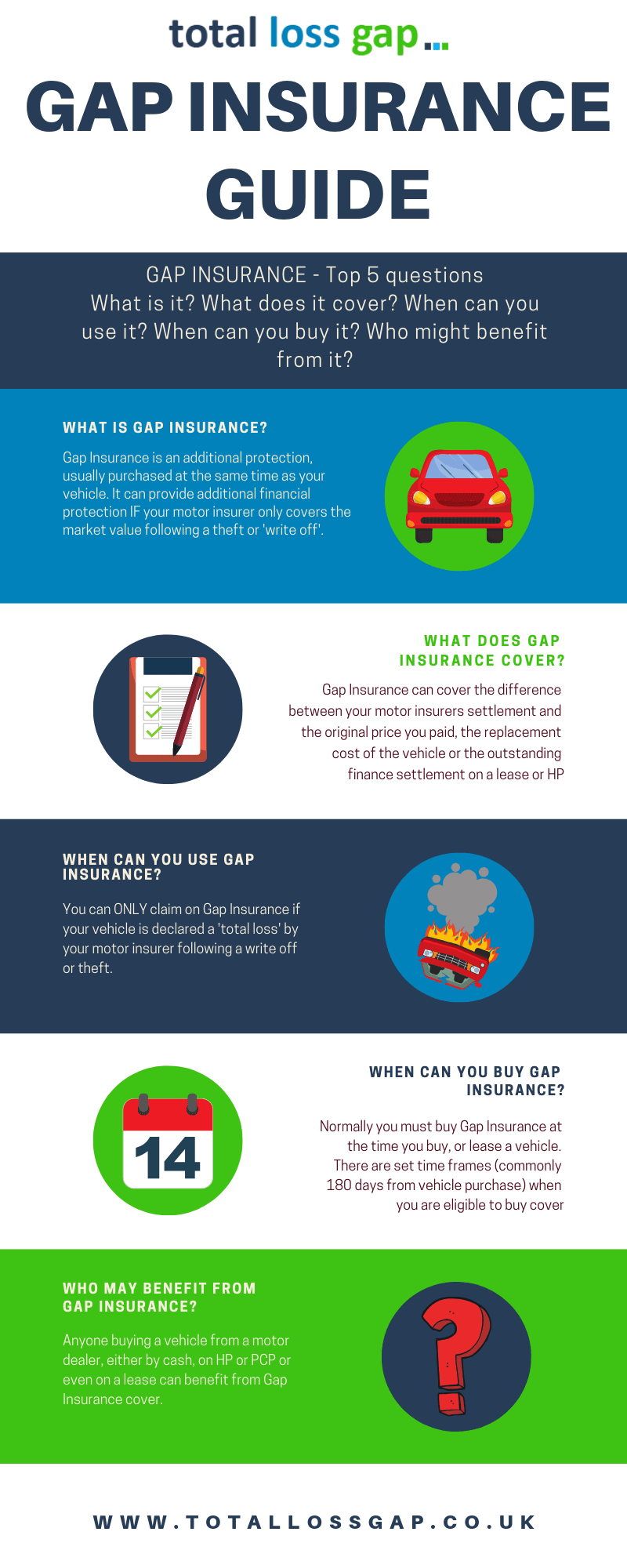

Imagine this scenario: you've been driving your brand-new car for a year, enjoying its shiny paint and the thrill of the open road. Then, disaster strikes. Your car is totaled in an accident, and your insurance company pays out a hefty sum. But, there's a catch – the payout isn't enough to cover your outstanding loan balance. You're left with a significant debt and the bitter taste of financial hardship. This is where gap insurance steps in, acting as a safety net to bridge the financial gap between your insurance payout and your loan balance.

Understanding the Gap

Gap insurance, often referred to as "loan/lease gap insurance," is a specialized coverage designed to protect you from the financial burden of a significant shortfall after a total loss or theft of your vehicle. It effectively covers the difference between the actual cash value (ACV) of your car, which is typically determined by the insurance company, and the outstanding loan or lease balance.

Why Does This Gap Exist?

The gap between the ACV and your loan balance arises due to the natural depreciation of your vehicle over time. As your car ages, its value decreases, while your loan balance remains relatively stable. This disparity can be particularly pronounced during the early years of your loan, when the depreciation rate is highest.

Table 1: Illustrating the Gap

| Scenario | Vehicle Purchase Price | Loan Amount | Loan Term | Depreciation After 2 Years | ACV After 2 Years | Gap |

|---|---|---|---|---|---|---|

| New Car | $30,000 | $25,000 | 5 Years | $5,000 | $25,000 | $0 |

| Used Car | $15,000 | $12,000 | 3 Years | $3,000 | $12,000 | $0 |

| New Car | $40,000 | $35,000 | 7 Years | $10,000 | $30,000 | $5,000 |

| Used Car | $20,000 | $18,000 | 4 Years | $5,000 | $15,000 | $3,000 |

Who Needs Gap Insurance?

While gap insurance can benefit anyone financing a vehicle, it's particularly crucial for:

- New car buyers: New cars depreciate rapidly, making them more susceptible to a significant gap.

- Individuals with longer loan terms: Longer loan terms amplify the depreciation effect, increasing the potential for a larger gap.

- Individuals with large down payments: While a larger down payment reduces your loan balance, it can still leave you exposed to a gap if your vehicle depreciates quickly.

- Individuals leasing a vehicle: Leases typically have a higher residual value, which may not be met by the actual market value of the vehicle at the end of the lease.

Types of Gap Insurance

There are two main types of gap insurance:

- Dealer-Offered Gap Insurance: This is typically bundled with your financing and is often the most expensive option. However, it's convenient and can provide peace of mind.

- Third-Party Gap Insurance: This is purchased separately from your lender or insurance company. It can offer more flexibility and potentially lower premiums, but you'll need to research and compare policies carefully.

Benefits of Gap Insurance

- Financial Protection: Gap insurance safeguards you from financial hardship by covering the difference between your insurance payout and your loan balance.

- Peace of Mind: Knowing you have gap insurance provides peace of mind, knowing you're protected from unexpected financial burdens.

- Potential Savings: In the event of a total loss, gap insurance can save you thousands of dollars by covering the gap and preventing you from being stuck with a significant debt.

Drawbacks of Gap Insurance

- Additional Cost: Gap insurance comes at an additional cost, adding to your overall vehicle financing expenses.

- Not Always Necessary: If you have a short loan term, a low loan balance, or a high down payment, the potential for a gap may be minimal.

- Potential for Overlap: If your existing insurance policy includes "loan/lease payoff" coverage, you may already have some gap protection.

How to Choose the Right Gap Insurance

- Compare Premiums: Get quotes from multiple providers to find the most competitive rates.

- Consider Your Loan Term and Down Payment: Assess your individual financial situation and the potential for a significant gap.

- Review Policy Details: Understand the coverage limits, exclusions, and any potential limitations of the policy.

Gap Insurance vs. Other Insurance Policies

Gap insurance is not a substitute for comprehensive or collision coverage. While these policies cover repairs or replacement for damages, they don't address the financial shortfall between the ACV and your loan balance.

Table 2: Comparing Insurance Policies

| Insurance Type | Coverage | Gap Coverage |

|---|---|---|

| Comprehensive | Covers damage from non-collision events (e.g., theft, vandalism) | No |

| Collision | Covers damage from accidents | No |

| Gap Insurance | Covers the difference between ACV and loan balance | Yes |

Conclusion

Gap insurance is a valuable financial tool that can protect you from significant financial burdens in the event of a total loss or theft of your vehicle. By understanding the potential for a gap and carefully considering your options, you can make an informed decision about whether gap insurance is right for you. Remember, peace of mind is priceless, and gap insurance can provide just that, knowing you're protected from unexpected financial hardship.

Note: This article is for informational purposes only and should not be considered financial advice. It's essential to consult with a qualified financial advisor to determine the best insurance options for your individual situation.

Related Articles:

- Navigating The Labyrinth: A Guide To Liability Coverage

- The Safety Net: Understanding Liability Car Insurance

- Navigating The Maze: A Guide To Car Insurance Quotes

- Behind The Wheel: Navigating The Labyrinth Of Car Insurance

- The Collision Coverage Conundrum: Demystifying A Vital Insurance Component

Closure

Thus, we hope this article has provided valuable insights into Filling the Gap: A Comprehensive Guide to Gap Insurance. We appreciate your attention to our article. See you in our next article!

'Insurance' 카테고리의 다른 글

| Navigating The Maze: A Guide To Car Insurance Comparison Websites (0) | 2024.07.26 |

|---|---|

| The Price Of Freedom: Driving Without Car Insurance (1) | 2024.07.25 |

| The Rise Of Usage-Based Insurance: A New Paradigm For Motorists (0) | 2024.07.23 |

| Driving Into Uncertainty: Navigating Rental Car Reimbursement (0) | 2024.07.22 |

| Navigating The Maze: A Guide To Car Insurance Quotes (0) | 2024.07.21 |