Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Price of Freedom: Driving Without Car Insurance. Let's weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Price of Freedom: Driving Without Car Insurance

The open road beckons, promising adventure and freedom. But before you hit the gas, there's a crucial question to consider: what happens if you drive without car insurance? The answer, unfortunately, is not a pleasant one. It's a gamble with potentially devastating consequences, both financial and legal.

The Risks of Uninsured Driving

Driving without insurance is like playing Russian roulette with your financial well-being. It's a risky move that can lead to a cascade of problems, each with its own set of consequences. Let's break down the main risks:

1. Financial Ruin:

- Accidents Happen: In the unfortunate event of an accident, even a minor fender bender, you'll be responsible for all costs, including:

- Medical Expenses: If you or another driver is injured, you'll be on the hook for medical bills, potentially reaching thousands or even millions of dollars.

- Property Damage: Repairing or replacing damaged vehicles, including yours and any other involved, will be your responsibility.

- Legal Fees: If the accident involves a lawsuit, you'll be facing hefty legal fees on top of everything else.

- No Protection: Without insurance, you have no financial safety net to cushion the blow of an accident. This can lead to crippling debt, bankruptcy, and even the loss of your home or other assets.

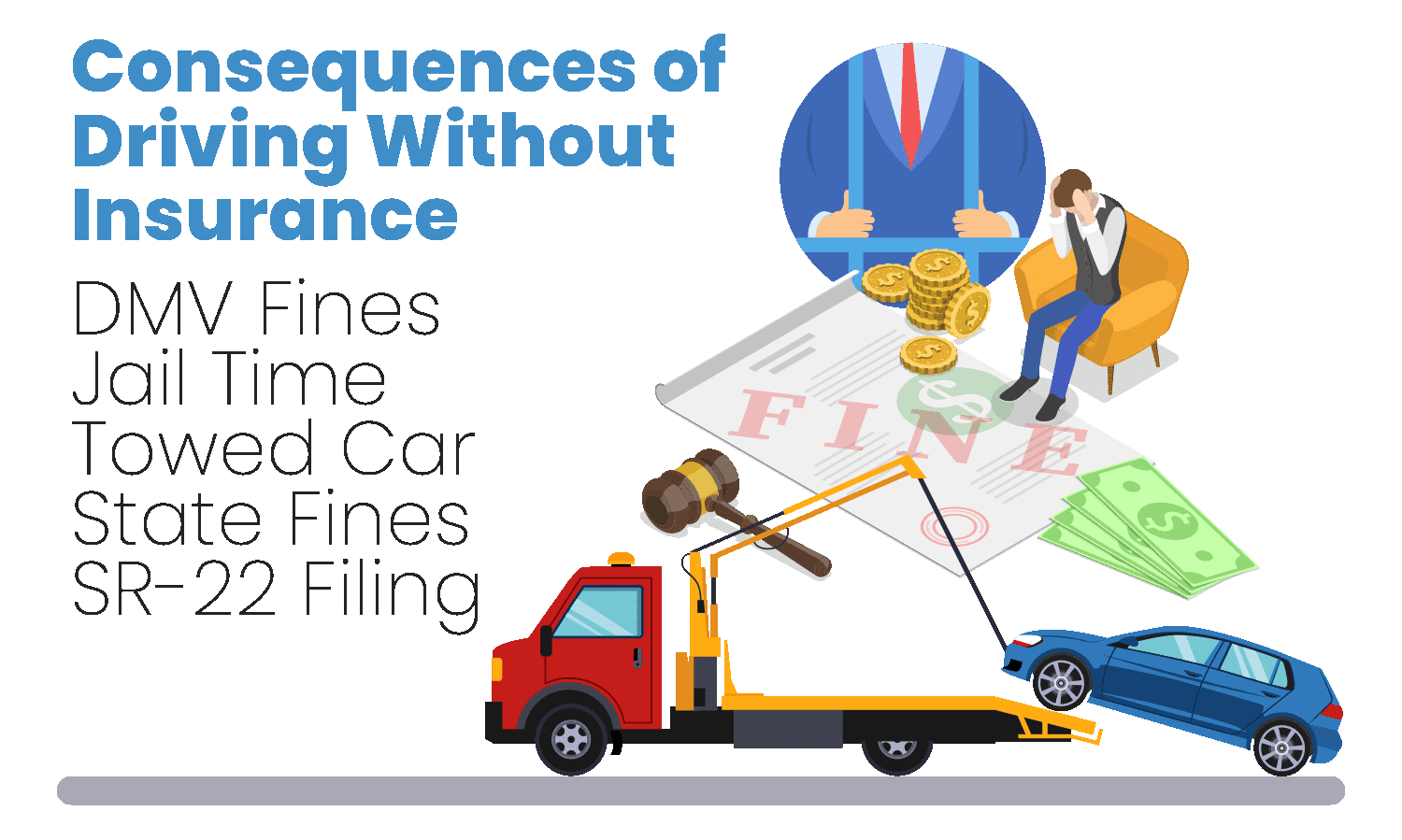

2. Legal Consequences:

- Fines and Penalties: Driving without insurance is a serious offense in most jurisdictions. You can expect hefty fines, license suspension, and even jail time.

- Criminal Charges: In some cases, driving without insurance can be considered a criminal offense, leading to a criminal record.

- Civil Liability: Even if you're not at fault in an accident, you can still be held civilly liable for damages, meaning you could be sued for a large sum of money.

3. Future Impacts:

- Higher Insurance Rates: Once you do get insurance, your premiums will be significantly higher due to your prior uninsured driving history.

- Difficulty Obtaining Insurance: Some insurers may refuse to offer you coverage due to your past driving record.

- Limited Driving Privileges: You may face restrictions on where you can drive or even be prohibited from driving altogether.

The Cost of Not Having Insurance:

Let's put these risks into perspective with some real-world examples:

Scenario 1: Minor Accident with Property Damage

- Cost of Repair: $2,000 for your vehicle, $1,500 for the other vehicle.

- Fines and Penalties: $500 for driving without insurance.

- Total Cost: $3,500

Scenario 2: Accident with Injuries

- Medical Expenses: $50,000 for your injuries, $100,000 for the other driver's injuries.

- Property Damage: $5,000 for your vehicle, $10,000 for the other vehicle.

- Legal Fees: $20,000 for your defense, $30,000 for the other driver's defense.

- Total Cost: $215,000

Scenario 3: Hit-and-Run Accident

- Criminal Charges: Jail time and a criminal record.

- Civil Liability: You could be sued for millions of dollars in damages.

The Cost of Having Insurance:

Now, let's compare these costs to the average annual cost of car insurance:

- Average Annual Premium: $1,400

The Cost-Benefit Analysis:

As you can see, the potential financial and legal consequences of driving without insurance far outweigh the cost of having insurance. It's a simple equation: the cost of insurance is a small price to pay for the peace of mind and protection it provides.

The Importance of Understanding Your Coverage

It's not enough to simply have car insurance; you need to understand the different types of coverage and how they protect you. Here's a breakdown:

- Liability Coverage: This covers damages to other people and their property if you cause an accident. It's the most basic type of coverage and is usually required by law.

- Collision Coverage: This covers damages to your own vehicle if you're in an accident, regardless of who's at fault.

- Comprehensive Coverage: This covers damages to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover your losses.

- Medical Payments Coverage: This covers your medical expenses, regardless of who's at fault, if you're injured in an accident.

Choosing the Right Coverage:

The best type of coverage for you will depend on your individual needs and financial situation. It's important to work with an insurance agent to find a policy that meets your requirements and fits your budget.

Table 1: Types of Car Insurance Coverage

| Type of Coverage | What It Covers |

|---|---|

| Liability Coverage | Damages to other people and their property if you cause an accident |

| Collision Coverage | Damages to your own vehicle if you're in an accident, regardless of who's at fault |

| Comprehensive Coverage | Damages to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters |

| Uninsured/Underinsured Motorist Coverage | Protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover your losses |

| Medical Payments Coverage | Covers your medical expenses, regardless of who's at fault, if you're injured in an accident |

Diagram 1: The Cost of Driving Without Insurance

[Insert a diagram that visually represents the financial and legal consequences of driving without insurance, compared to the cost of having insurance.]

Driving Without Insurance: A Risky Gamble

Driving without insurance is a gamble with high stakes. The potential financial and legal consequences are significant, and the cost of insurance is a small price to pay for the peace of mind and protection it provides. Before you hit the road, make sure you have the right insurance coverage to protect yourself and others. Remember, the open road is a beautiful place, but it's also a dangerous one. Don't let your freedom turn into a nightmare.

Related Articles:

- Navigating The Maze: A Guide To Comparing Car Insurance

- Hit And Run: A Collision Of Law And Ethics

- Filling The Gap: A Comprehensive Guide To Gap Insurance

- The Price You Pay For Peace Of Mind: A Deep Dive Into Car Insurance

- Navigating The Labyrinth: A Guide To Liability Coverage

Closure

Thus, we hope this article has provided valuable insights into The Price of Freedom: Driving Without Car Insurance. We appreciate your attention to our article. See you in our next article!

'Insurance' 카테고리의 다른 글

| The Price You Pay For Peace Of Mind: A Deep Dive Into Car Insurance (0) | 2024.07.27 |

|---|---|

| Navigating The Maze: A Guide To Car Insurance Comparison Websites (0) | 2024.07.26 |

| Filling The Gap: A Comprehensive Guide To Gap Insurance (1) | 2024.07.24 |

| The Rise Of Usage-Based Insurance: A New Paradigm For Motorists (0) | 2024.07.23 |

| Driving Into Uncertainty: Navigating Rental Car Reimbursement (0) | 2024.07.22 |